CA A-1-131 2008-2026 free printable template

Show details

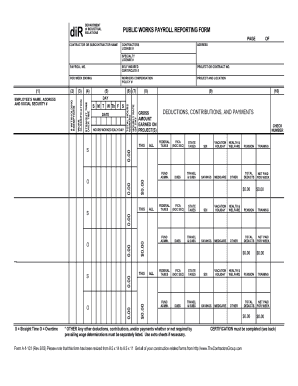

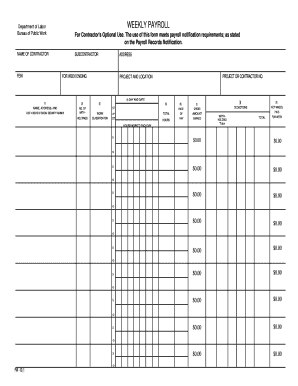

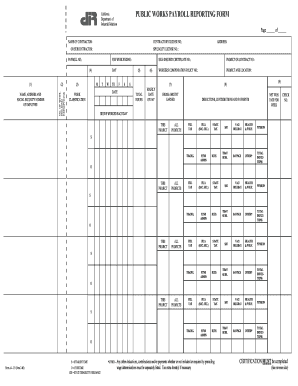

CERTIFICATION must be completed see back Form A-1-131 Rev 01/08 Please note that this form has been resized from 8. DIR CALIFORNIA DEPT. OF INDUSTRIAL RELATIONS PUBLIC WORKS PAYROLL REPORTING FORM PAGE CONTRACTOR/SUBCONTRACTOR NAME ADDRE CONTRACTORS LICENSE OF PROJECT NAME AND ADDRESS OR LOCATION DESCRIPTIO SPECIALTY LICENSE STRAIGHT TIME OVERTIME WORK CLASSIFICATION WITHHOLDING EXEMPTIONS EMPLOYEE S NAME ADDRESS AND SOCIAL SECURITY WORKERS COMPENSATION POLICY S/T GROSS AMOUNT EARNED ON...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign a 1 131 form

Edit your form a 1 131 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a 1 131 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dir payroll reporting form online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit dir certified payroll form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA A-1-131 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out dir form a 1 131

How to fill out CA A-1-131

01

Obtain the CA A-1-131 form from the official website or local tax office.

02

Fill in your personal information including name, address, and social security number.

03

Indicate the reason for filing the form in the designated section.

04

Ensure that you provide any necessary supporting documentation as required.

05

Double-check all filled information for accuracy.

06

Sign and date the form at the bottom.

07

Submit the completed form to the appropriate tax authority, whether by mail or online.

Who needs CA A-1-131?

01

Individuals who need to request a refund or appeal a decision made by the California tax authority.

02

Taxpayers seeking to resolve issues related to their California tax filings.

Fill

california works payroll

: Try Risk Free

People Also Ask about public works payroll reporting form

Will QuickBooks do certified payroll?

Sign into QuickBooks as the Primary Administrator. Make sure you're in single-user mode. Go to Reports, then select Employees & Payroll. Select More Payroll Reports in Excel, then Certified Payroll Report.

What is DIR for payroll?

The Department of Industrial Relations (DIR) was established in 1927. Its mission is to improve working conditions for California's wage earners and to advance opportunities for profitable employment in California.

What is the difference between payroll and certified payroll?

Certified Payroll is a company's accounting of everything paid out under a contract performed for a government client, while Wrap-Up Payroll is what a company has to report to their Workers Compensation Carrier for the state in which they are doing the work.

Can QuickBooks do certified payroll?

Step 5: Create a certified payroll report Sign into QuickBooks as the Primary Administrator. Make sure you're in single-user mode. Go to Reports, then select Employees & Payroll. Select More Payroll Reports in Excel, then Certified Payroll Report.

Does Paychex do certified payroll?

Ideal for employers with union employees and Certified Payroll projects: HCM TradeSeal extends Paychex to support union Certified Payroll needs.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send dir certified payroll form pdf for eSignature?

To distribute your certified payroll california dir fillable form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Where do I find dir a 1 131 form fillable?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the how to public works payroll reporting form. Open it immediately and start altering it with sophisticated capabilities.

How do I edit public payroll reporting form on an Android device?

The pdfFiller app for Android allows you to edit PDF files like forma 1 131. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is CA A-1-131?

CA A-1-131 is a form used in California for reporting certain tax-related information to the state.

Who is required to file CA A-1-131?

Individuals or businesses that meet specific criteria related to income or transactions that require reporting to the state are required to file CA A-1-131.

How to fill out CA A-1-131?

To fill out CA A-1-131, you should provide accurate information regarding your income, deductions, and any other required data as specified by the form instructions.

What is the purpose of CA A-1-131?

The purpose of CA A-1-131 is to ensure compliance with state tax regulations by collecting detailed financial information from filers.

What information must be reported on CA A-1-131?

CA A-1-131 requires reporting of personal identification information, income details, applicable deductions, and other relevant financial information as required by the form.

Fill out your CA A-1-131 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fillable Form A 1 131 is not the form you're looking for?Search for another form here.

Keywords relevant to form a 1 131 new 2 80

Related to a131 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.